Electric automaker Rivian reported its Q3 2023 earnings, highlighting increased production volumes but continued steep losses as the company scales up.

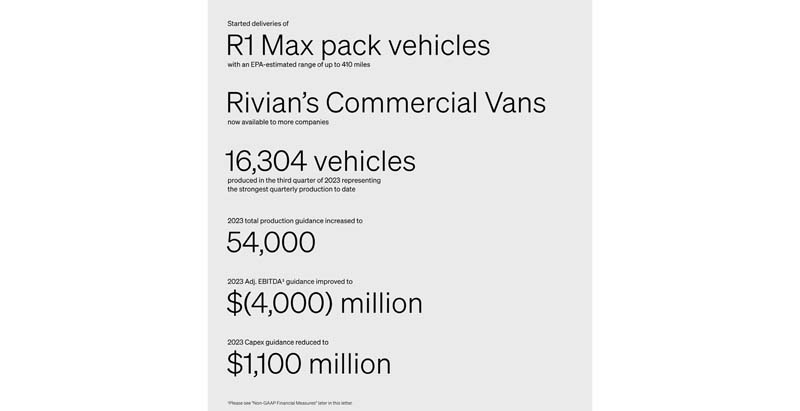

In Q3, Rivian produced 16,304 vehicles, up 67% from Q2 production of 9,774 vehicles. Deliveries grew similarly to 15,564 vehicles in Q3, up from 4,467 deliveries in Q2, R1S SUV accounted for most of the production output during the quarter.

However, wider losses persisted even with the production ramp. Rivian posted a net loss of $1.37 billion in Q3 2023 compared to a $1.72 billion net loss for Q3 2022, equates to losses of approximately $30,648 for every vehicle delivered in the quarter.

On a per day basis, Rivian averaged losses of $14.8 million during Q3 as it continues investing heavily in growth while dealing with inflationary pressures.

Total revenue rose to $1.33 billion, driven primarily by the 15,564 vehicles delivered. But development costs and factory startup expenses outweighed the revenue, sinking overall profitability.

Gross profit margin remained negative at -35.6% as Rivian’s average per-vehicle cost of goods sold stays above revenue. But this was an improvement from -93.4% in Q2 2023.

On the production side, Rivian is ramping up well, during Q3 almost doubled versus Q2 as all models including the Dual-Motor and Max pack R1 variants ramped up at the company’s Normal, Illinois factory.

Given the momentum, Rivian has raised its total 2023 production guidance to a range of 54,000-56,000 vehicles. That’s up from the 50,000 target provided last quarter, signaling increased confidence.

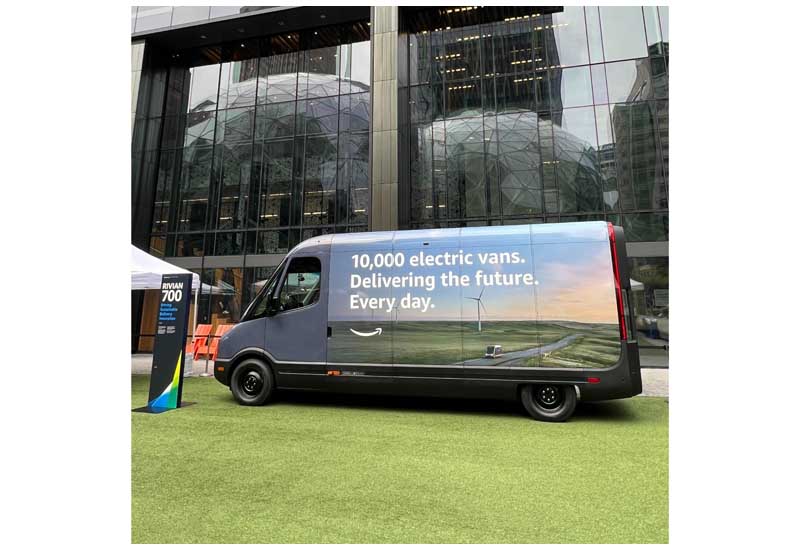

Rivian also announced plans to enable other companies to purchase its commercial van that was custom-designed for Amazon. Rivian says it remains focused on delivering 100,000 vans to Amazon.

With its R1 pickup truck and SUV lineup expanding, and the commercial van program scaling, Rivian is making steady progress on production. But profitability remains elusive amid massive spending, supply chain volatility, and rising costs across the automotive sector.

Rivian had over $13 billion in cash heading into Q4 2023, providing substantial runway. However, the central challenge is narrowing losses and reaching sustainable positive margins as programs grow. Ramping up efficiently and controlling costs will be key in the quarters ahead.