When it comes to Elon Musk’s increasingly iron-fisted grip over Tesla, ardent shareholder Cathie Wood remains firmly aboard the autocratic express. The Ark Invest boss has vocalized full-throated support for the eccentric billionaire’s ploys to shift the EV titan’s headquarters to his personal Texas fiefdom and amass outright voting control of the company.

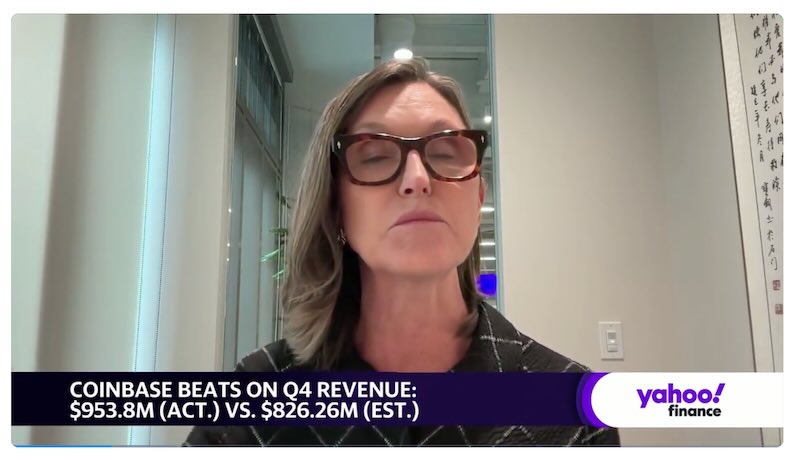

In a recent interview, Wood didn’t mince words defending Musk’s attempts to wrestle shares away from “short-term oriented” outside investors jeopardizing his grand long-term vision. She lambasted a Delaware judge’s ruling against Tesla’s $56 billion CEO compensation package, approved overwhelmingly by shareholders in 2018, as downright “un-American.”

“The judge basically took the vote away from us,” Woods seethed about the controversial decision nullifying the unprecedentedly lucrative pay plan. “We voted for that package, 73% of shareholders did…it’s an insult to the Tesla board.”

Beyond that legal fracas though, Wood stridently backed Musk’s aspirations to relocate Tesla’s statutory home to the Lone Star State, free of pesky Delaware oversight. The move aligns with his broader objective of consolidating supreme decision-making power in perpetuity through supercharged voting shares.

“For many of our companies, we support super voting rights because visionary leaders need to execute on their vision without short-term shareholder distraction,” Wood extolled Musk’s motivation. She even likened the mercurial CEO’s go-it-alone tendencies to elite innovators throughout history persistently dragging the world into the future.

“Elon Musk is the inventor of our age…our Renaissance man,” Wood gushed. “I’m surprised at the pushback he receives!”

Surprise or not, Musk’s mounting demands for unchecked autonomy have supercharged longstanding corporate governance criticisms of Tesla’s insular top ranks. The iconic founder’s escalating hostility toward any perceived dissent – shareholder, employee, legal or otherwise – evokes Shakespearean visions of a once-beloved leader unraveling into uncompromising tyrant.

Of course, Woods’ full-bodied endorsement makes strategic sense from a certain myopic view. After all, Ark remains Tesla’s third largest institutional investor with nearly $1 billion riding on Musk’s continued dominance over the company’s direction. Protecting that gargantuan position outweighs any niceties around accountability or shareholder rights.

Still, Wood’s unflinching fealty to Musk’s control-consolidation crusade elicits uncomfortable echoes of the bygone “brilliant founder” mythologies that enabled monster despots of business past. Maybe Del Monte felt the same way about United Fruit’s machinations at one point?

In the age of stakeholder capitalism though, backing Tesla’s transformation into a founder-led monarchy rings increasingly discordant. Visionary or not, Musk seems destined to spark an existential reckoning around how much concentrated power markets should permit any single human – no matter their talent or resume.