When Lucid, the ambitious electric vehicle (EV) startup, released its Q4 2023 earnings report, it was met with a collective groan from investors and industry analysts alike. The numbers were, well, less than stellar, with revenue clocking in at a disappointing $157 million, a whopping 39% nosedive compared to the previous year. But that’s not even the worst of it – the company’s net loss for the quarter ballooned to a staggering $636 million, a 35% increase year-over-year.

As if that wasn’t enough to raise eyebrows, Lucid dropped another bombshell: they expect to produce a mere 9,000 vehicles in 2024.

Enter Elon Musk, the outspoken and ever-candid CEO of Tesla, who wasted no time in weighing in on Lucid’s dismal performance. In a classic Musk move, he took to Twitter (now rebranded as X) and delivered a scathing assessment, quipping, “Their Saudi sugar daddy is the only thing keeping them alive.”

Now, for those unfamiliar with the backstory, Lucid has received substantial investment from Saudi Arabia’s sovereign wealth fund, a fact that Musk clearly hasn’t forgotten – or forgiven, it seems.

But wait, there’s more! A X user decided to remind Musk of Tesla’s own brush with financial peril back in 2008, mentioning the $50 million lifeline from Mercedes and the Saudis. Musk, ever the historian, swiftly corrected the record, clarifying that it was actually a $50 million investment from Daimler in May 2009 that truly saved Tesla from bouncing payroll a mere month later.

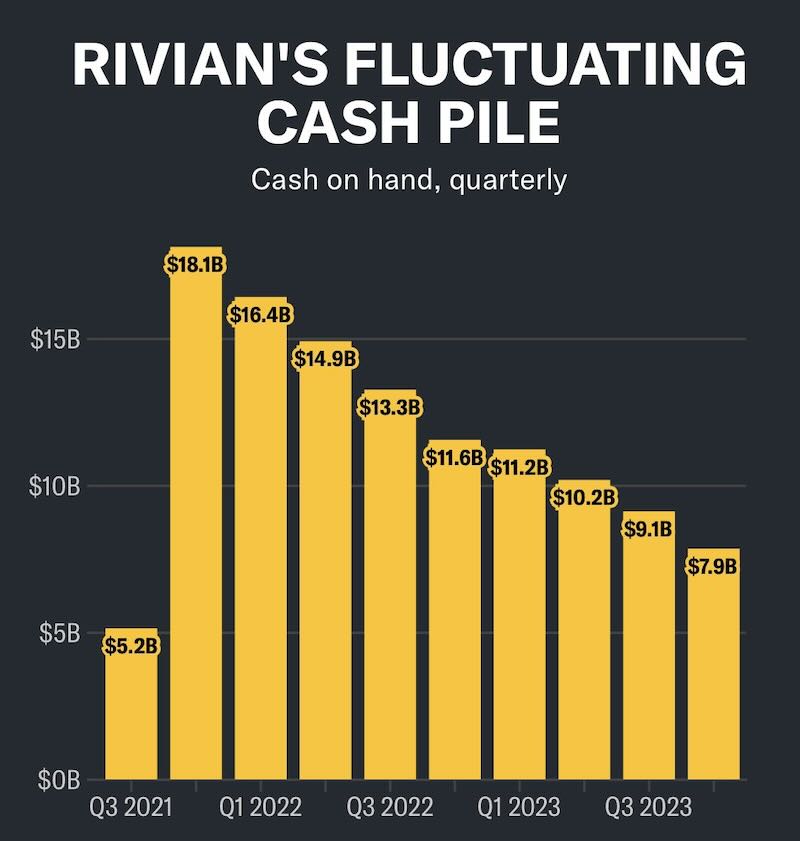

As the Twitterverse erupted with speculation and commentary, another user couldn’t resist asking Musk about his thoughts on Rivian, the electric truck maker that’s been making waves (and burning through cash) in recent years. Musk didn’t mince words, declaring that Rivian’s “current trajectory has them bankrupt in ~6 quarters. Maybe that trajectory will change, but so far it hasn’t.”

But wait, there’s a glimmer of hope! Musk acknowledged that Rivian’s product design isn’t bad, but he quickly followed up with a sobering truth: “The actual hard part of making a car company work is achieving volume production with positive cash flow.”

And there you have it, folks – a candid glimpse into the mind of one of the automotive industry’s most polarizing figures. Love him or hate him, Musk’s unfiltered commentary has once again ignited a heated discussion about the challenges faced by EV startups and the harsh realities of sustaining a viable automotive venture.

As the dust settles on Lucid’s underwhelming earnings and Musk’s biting remarks, one thing is clear: the road to success in the EV realm is paved with obstacles, and only the most resilient and financially savvy players will emerge victorious.