Tesla whiffed on Wall Street’s delivery expectations for Q1 2024, Wall Street analyst George Gianarikos is urging investors to keep an open mind about the root causes. In a new research note, the Canaccord Genuity analyst George reiterated his Tesla price target of $234 and BUY rating, presents two potential “adventures”.

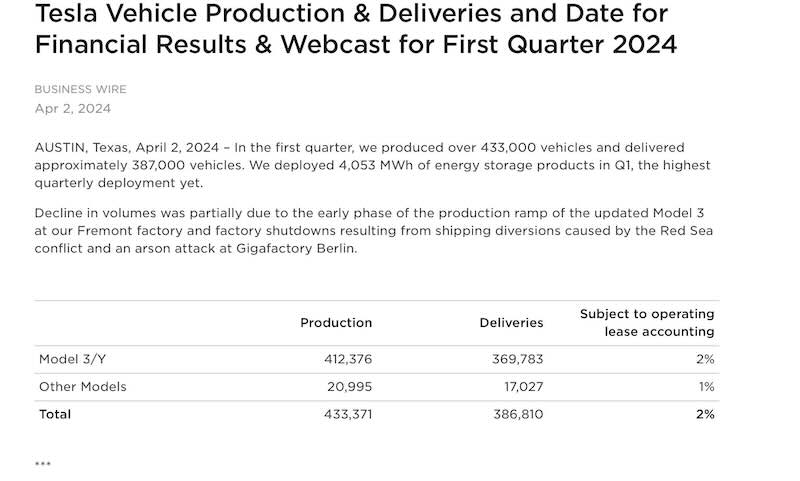

For the Q1, Tesla produced 433,371 vehicles but only delivered 386,783 to customers – a massive 46,588 unit gap that raised eyebrows. Musk cited issues like the updated Model 3 production ramp and factory shutdowns.

George Gianarikos wants investors to “choose their own adventure” for what really drove the disparity. His first theory, the “Demand Issue” adventure, is that weakening order flow late in the quarter forced Tesla to pump the brakes on deliveries.

“The company kept producing cars…that it could not sell at the end of the quarter due to an unexpected demand slowdown,” the analyst hypothesizes, pointing to elevated Model Y inventory in the U.S.

Gianarikos’ other “Supply Issue” adventure? That Tesla was so focused on finally ramping the revamped Model 3, Cybertruck and Berlin Model Y lines that it produced far more vehicles than it could deliver by quarter’s end. Newly updated Model 3 lead times now stretch into June.

“The truth probably lies in the middle,” he admits. But Gianarikos seems to lean toward supply chain constraints being the bigger bottleneck for Tesla in Q1.

Regardless of which root cause ultimately gets more blame, one thing is clear – all eyes will be on Tesla’s Q1 earnings call later this month. Management for clarity on whether the delivery shortfall stems from a demand problem or supply headaches.

Gianarikos makes a compelling case that if major products like Cybertruck were fully ramped, “the story of the quarter would have been much different.”

Related: Tesla Delivered in Q1: Talks Up Tesla Potential Amid Q1 Delivery Disappointment