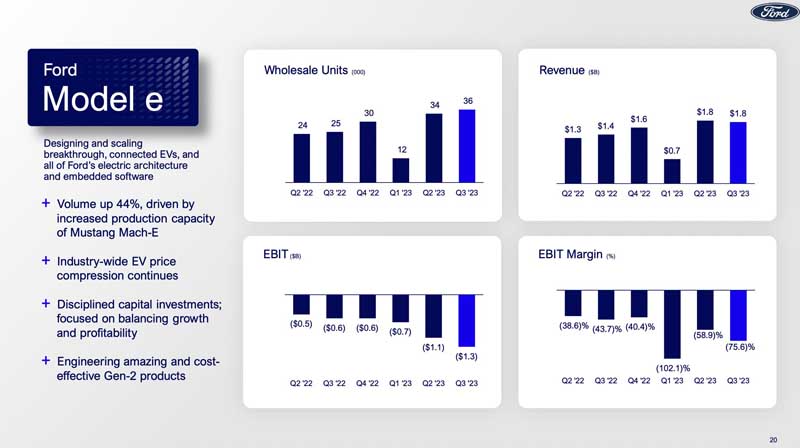

Ford’s latest quarterly earnings release reveals the auto giant is struggling to make its electric vehicle pivot profitably amid intense competition. The company’s EV unit posted staggering losses of $1.3 billion for Q3 2023 with an EBIT margin of -75.6% as pricing and manufacturing costs weigh heavily.

Full Q3 2023 earnings pdf page: https://s201.q4cdn.com/693218008/files/doc_financials/2023/q3/Q3-2023-Corporate-Earnings-Slides.pdf

According to Ford, part of the problem stems from North American customers being unwilling to pay the higher sticker prices generally commanded by EVs compared to gas or hybrid models. This resistance to paying EV premiums is compressing prices and profitability as automakers fight for share.

Ford sold 36,000 EVs in Q3, generating $1.8 billion in revenue. But steep production costs including battery materials resulted in eye-popping EBIT losses ballooning to $1.3 billion – the highest deficit yet.

Ford Q2 Earnings Report Reveals Strong EV Sales But Heavy Losses

Making matters worse, Ford’s EV margins slid even further into negative territory compared to Q2 2022 when losses sat at -58.9%. The rapid deterioration highlights how unsustainably unprofitable Ford’s EV operations remain currently.

While demand for electric Fords remains healthy, the company has yet to find a formula for delivering vehicles profitably amidst commodity headwinds and cutthroat competition.

Ford says part of its strategy involves slashing operating and material costs aggressively to restore sustainable margins. But on the demand side, Ford is stuck battling rivals to avoid pricing itself out of the nascent mass-market EV segment.

Until battery costs decrease significantly or customers become amenable to higher EV prices, Ford faces a bumpy road to justifying its massive $50 billion EV investment spree. Shareholders are surely growing impatient as losses mount.

While electric vehicles are clearly the future, they are proving a financial quagmire for legacy automakers to navigate currently. Ford’s reliance on gas-guzzling trucks and SUVs for profits hampers their transition flexibility.

Until Ford can unlock a clear path to selling EVs profitably at scale, massive losses appear poised to become the norm. Their Q3 earnings illustrate how electric vehicles remain a money pit despite surging consumer demand. Ford needs a turnaround plan fast before EV despair truly sets in.