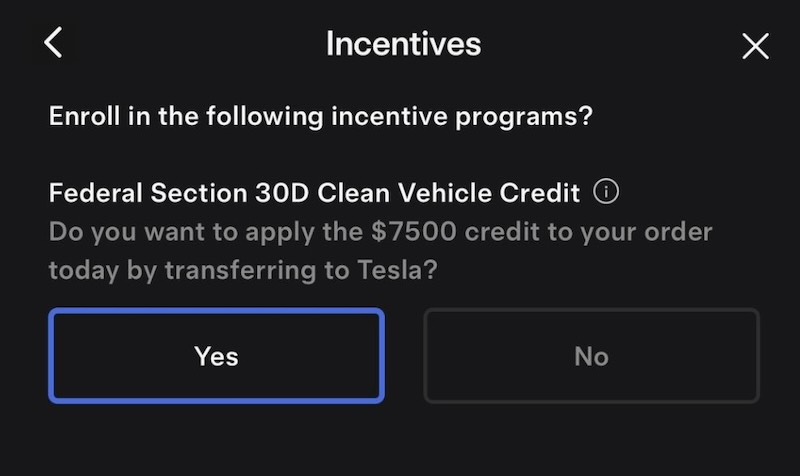

Tesla has officially activated the new $7,500 federal electric vehicle point-of-sale tax credit, enabling an estimated 250 million more Americans to receive the full discount directly off the purchase price of a new Tesla EV.

Previously, the tax credit was only available as a rebate when filing taxes. Now, Tesla customers can get the discount immediately at the time of purchase, significantly lowering the entry price. This will make Tesla vehicles more accessible to millions of new potential buyers.

How does the new federal EV tax credit work?

The recently passed Inflation Reduction Act turned the previous federal EV tax credit into an instant discount. Now, instead of waiting to get the money back as a rebate later, buyers can deduct up to $7,500 off the purchase price of a qualifying EV like the Tesla Model 3, Model Y, Model S or Model X.

The credit applies at the point of sale, so you’ll see the discounted price when ordering a new Tesla vehicle. For example, with the full $7,500 credit, the Model Y now starts at just $36,490.

Tesla has updated its website with the following details: “Eligible customers who take delivery of a qualified new Tesla and meet all federal requirements are eligible to receive $7,500 off the purchase price. Applied at time of delivery. Customers can purchase up to two vehicles per year with the tax credit applied directly to the purchase price.”

What are the eligibility requirements?

The income limits from 2022 still apply. Your modified adjusted gross income (AGI) must be below certain thresholds – $150,000 for single filers, $225,000 for head of household, and $300,000 for joint filers.

The great news is you can use your AGI from the year you take delivery of your new Tesla or the prior year, whichever is less. So even if you exceed the limits in 2024, you may still qualify if your 2023 AGI was below the caps.

This means the full $7,500 discount is now accessible to an estimated 250 million Americans, up from around 75 million under the previous rebate structure. Tesla buyers no longer have to wait months to get the money back or have a large tax liability to benefit.

As the federal EV tax credit enters this new instant discount phase, Tesla is leading the transition by integrating it directly into their ordering process. Drivers can now get $7,500 off right away instead of waiting until tax season. This will likely accelerate EV adoption by making Tesla vehicles more affordable upfront for millions of new customers.