Ford released Q4 and full-year 2023 earnings, beating expectations on both revenue and profitability. However, the automaker continues to pull back on electric vehicle (EV) investments after slower than anticipated demand.

For Q4, Ford generated $46 billion in revenue, up 4% year-over-year, driven by positive net pricing. This exceeded analyst estimates of around $40 billion. Adjusted earnings per share of $0.29 also topped expectations of $0.14.

While Ford posted a net loss of $526 million for the quarter due to a UAW wage adjustment, its full year net income increased to $4.3 billion. Adjusted EBIT was essentially flat at $10.4 billion.

Ford delivered a record 25,637 EVs in Q4, a 24% increase. The F-150 Lightning surpassed the Rivian R1T as the best selling electric pickup while the Mustang Mach-E was the second highest selling electric SUV behind the Tesla Model Y.

However, Ford continues to cut back on EV spending and scale down production in the face of weaker demand and mounting losses. Ford slowed EV investments by $12 billion last year and recently announced plans to cut F-150 Lightning output for a second time in five months, (Ford Slashes 2024 F-150 Lightning Production Plans, From 3,200 a week today to 1,600).

CFO John Lawler stated Ford is “changing the pace and flow” of EV manufacturing capacity, including halving production levels at its Marshall plant. Competitor GM also pivoted its “all-in on EVs” strategy to include more hybrids.

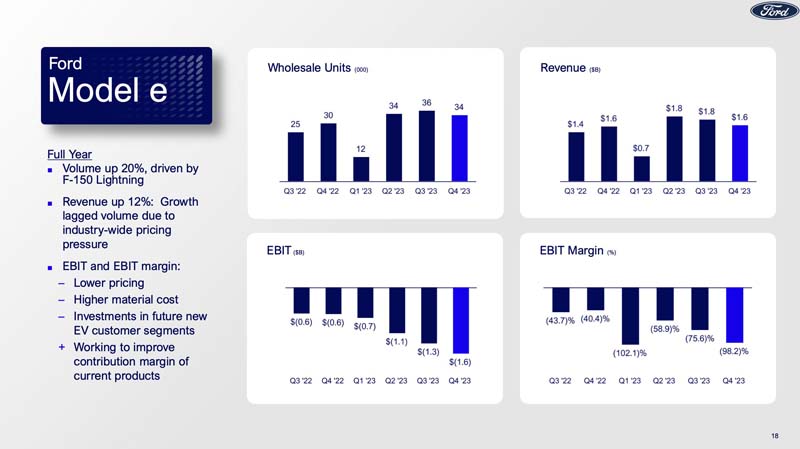

Ford’s electric vehicle business, Model e, posted a $4.7 billion loss for 2023 driven by highly competitive pricing and investments in future products. While EV volume grew 20%, operating income dropped to $1.6 billion as margins hit -98.2%.

Lawler cited “extremely competitive pricing” in the EV space as well as continued investments in next generation vehicles. The company lost about $47,000 for each EV sold in Q4, higher than the previous three quarters.

Despite tempering EV ambitions, Lawler reiterated that “EVs are here to stay, customer adoption is growing, and their long-term upside is central to Ford+.”

In more positive news, Ford’s services business saw software subscriptions increase 8% to 630,000. The automaker also expanded its hands-free driving system, BlueCruise, to more European markets.

For the full year of 2024, Ford expects EBIT between $9 billion and $11 billion driven by strong customer demand. While it continues targeting over 2 million EV volume by 2026, Ford is clearly adopting a more cautious stance in the face of market realities.

The Q4 results showcase Ford’s resilience but also the difficult road ahead as legacy automakers transition to electric. With rising costs and competition, Ford is wisely throttling back on EVs to focus on profitable growth.