Tesla has done it again – stunned the world with its impressive Q2 figures, with new car production reaching a whopping 480,000 and deliveries surpassing 466,100, Tesla Q2 2023 Production and Deliveries Break Records, Nearly 480k Vehicles), the EV behemoth has not only maintained its global leadership in pure electric vehicle deliveries, but it has also set a new record for quarterly deliveries. And guess what? Wall Street analysts had forecasted a mere 448k vehicles.

As if on cue, Tesla’s stock price surged nearly 7% in pre-market trading, and its market value is expected to increase by a cool $50 billion, landing at around $900 billion.

Currently, Tesla’s stock price is hovering around $280, more than doubling since the beginning of the year and leaving analysts’ price targets in the dust. But as always, there’s a catch. Some Wall Street analysts have raised concerns about Tesla’s profit margin, given its strategy of offering significant discounts to boost sales.

However, at least three analysts have upped their target stock price for Tesla, pointing out that the previously estimated annual delivery target of 1.8 million cars seems rather conservative, as Tesla has already delivered nearly 900,000 cars in the first half of 2023. With supply chain issues easing, it’s widely predicted that Tesla’s deliveries in the second half of the year will be even more impressive.

Tesla’s gross margin in Q1 was 19.3%, and Wall Street expects this figure to drop to 18.6% in Q2. Despite the potential profit pressure, some analysts still believe that Tesla’s stock price may continue its upward trajectory as the company expands its global market share and its charging standard NACS is about to become the U.S. standard.

Charging Standards NACS vs CCS: How Tesla NACS is Changing the Game

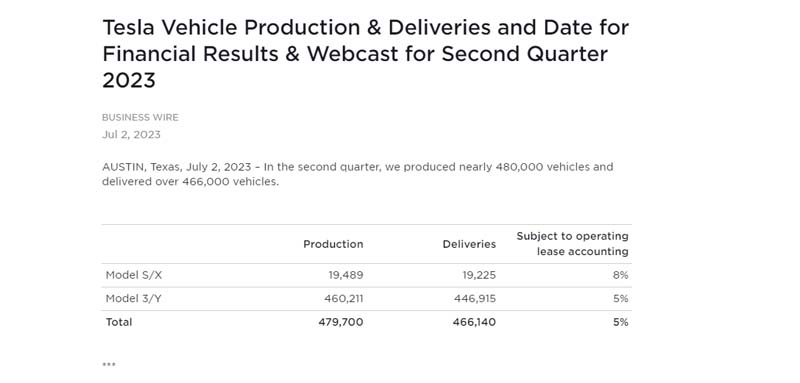

In Q2 2023, Tesla produced a total of 479,700 new cars, marking an increase of about 86% YoY and 63% QoQ. Deliveries in Q2 reached 466,100, an increase of about 83% YoY and 57% QoQ, with an average of 5,122 deliveries per day.

Tesla’s Model 3 and Model Y, both clear sales volume winners, accounted for 96% of global deliveries. Their production volume was 460,211, an increase of 90% YoY and 65% QoQ. The delivery volume of Model 3 and Model Y reached 446,915, an increase of 87% YoY and 61% QoQ.

Meanwhile, the total production volume of Model S and Model X was 19,489, an increase of 19% YoY and 27% QoQ, and the total delivery volume was 19,225, a decrease of 3% QoQ.

In Q2, Tesla sold 13,560 fewer cars than it produced during this period. In Q1, Tesla also produced more cars than it delivered, with a difference of about 18,000 cars. This indicates that the inventory surplus problem that began this year still exists, but it has somewhat eased in Q2.

Tesla didn’t mention the data of vehicles in transit in its press release, which may suggest that there are still many vehicles in inventory rather than in transit.

Just two weeks before announcing the record delivery data, many short-selling institutions were bearish on Tesla’s stock, and major Wall Street investment banks had been downgrading Tesla’s stock rating. Morgan Stanley and Barclays, two major investment banks, downgraded Tesla’s stock rating, with Morgan Stanley stating that the optimistic sentiment related to AI had pushed Tesla’s stock to a “reasonable valuation,” and Barclays Bank claiming that its rise was too large and too fast.

Goldman Sachs also downgraded Tesla’s stock rating to “Neutral” last week. However, Tesla’s recent market trend has not developed as they analyzed. In May and June of this year, Tesla’s stock price soared for 13 consecutive trading days, with a cumulative increase of more than 40%, and its market value increased by nearly $240 billion.

JPMorgan Raises $TSLA Price Target to $120 (from $115), Maintains Underweight Rating, Deutsche Bank maintains $TSLA at buy and increased their price target of $270.

Just as Tesla announced its best-ever Q2 delivery data, a turnaround occurred, and Wall Street investment bank Wedbush began to be bullish on Tesla. Although Wall Street has had too many doubts about Tesla in the past few months, Q2 delivery volume is another trophy for Musk and Tesla.

Low prices have always been a powerful tool for harvesting sales, and breaking delivery records cannot be separated from two words: low prices.

Since the end of last year, Tesla has launched a large-scale price reduction mode in China, Europe, and the United States, from official discounts to various preferential activities such as insurance points. In 2023, Tesla became unstoppable, and at the beginning of the year, it lowered the prices of domestic Model 3 and Model Y to historic lows, (Tesla Goes to War in Europe: The Plan to Kill Internal Combustion Engine (ICE)), triggering a price war in the auto market.

Tesla Model Y World’s Best-Selling Car, Topping Corolla and RAV4

In the United States, Tesla has received support from the federal government’s electric vehicle tax credit, which has increased from $1,875 to $7,500, making Tesla’s electric vehicles more affordable. In addition, Tesla’s battery technology has also benefited from economies of scale, which have driven down production costs and allowed Tesla to offer more competitive prices.

However, some analysts have expressed concerns about the impact of Tesla’s aggressive pricing strategy on its profit margin. Tesla has been offering significant discounts to increase sales, and this may have an adverse effect on its profitability. In addition, Tesla faces increasing competition in the electric vehicle market, with traditional automakers such as Ford and General Motors also launching electric vehicles.

Despite these challenges, Tesla’s strong Q2 delivery data has boosted investor confidence, and many analysts believe that Tesla’s stock price may continue to rise in the future. Tesla’s leadership in electric vehicle technology, its global market share, and its charging standard NACS becoming the U.S. standard are all factors that may contribute to its future growth.

Tesla’s Q2 delivery data has sent a clear message to the market: the electric vehicle giant is here to stay, and it’s not afraid to break records. While concerns about profit margins and increased competition remain, Tesla’s position as a leader in the EV industry seems unshakable. As the world continues to embrace electric vehicles and Tesla keeps pushing the boundaries of innovation, the sky’s the limit for this trailblazing company.