Tesla reported Q3 2023 deliveries of 435,000 vehicles, falling short of Wall Street estimates of 465,000. However, Tesla maintained its guidance of 1.8 million vehicle deliveries for 2023. Morgan Stanley Adam Jonas weighed in with its take on Tesla’s results and what they mean for the company going forward.

Q3 2023 Delivery Shortfall Was Expected

While Tesla missed forecasts, the Q3 delivery figure was in line with Morgan Stanley’s expectations, firm expects smoother growth ahead once Tesla stabilizes production and launches refreshed Model 3 highland deliveries start and updated Giga Shanghai Model Y deliveries start vehicles.

Tesla New Refreshed Model 3 Design, Price, SPECS Performance and EPA estimated range

Tesla Rolls Out Subtle Model Y Updates From Giga Shanghai

Profitability Remains Healthy

Despite the top-line miss, Morgan Stanley sees Tesla Q3 2023 margins coming in at a robust 9.6%. Q4 2023 margins are estimated even higher at 9.8%, showcasing Tesla’s industry-leading operational efficiency. As production scales further, profitability should continue rising over the long-term.

EV Adoption Faces Headwinds

Morgan Stanley acknowledges EV demand continues growing globally. However, near-term adoption faces challenges like raw material constraints, charging infrastructure gaps, geopolitical issues, and affordability concerns. While Tesla remains well-positioned overall, the path toward mass EV penetration will have bumps.

Tesla Leads in Technology and Costs

As the most vertically integrated EV maker, Tesla maintains key advantages in proprietary technology, manufacturing costs, and battery supply security. The firm believes Tesla is uniquely positioned to drive ongoing EV engineering breakthroughs and cost reductions.

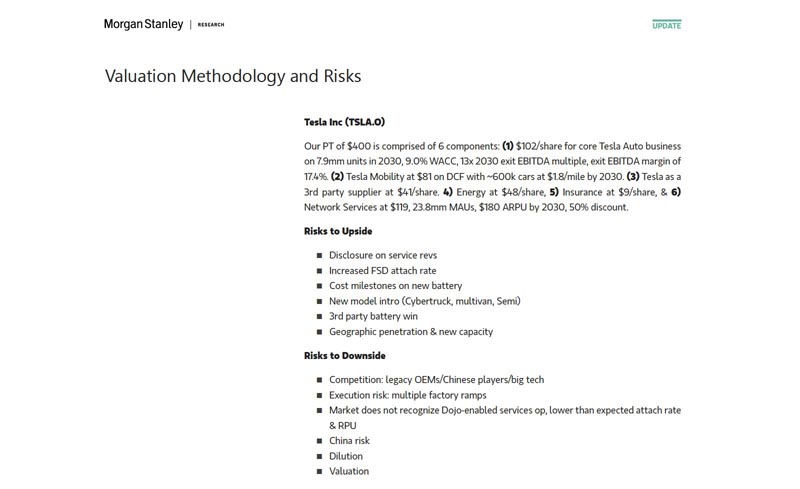

$400 Price Target Based on Future Business Segments

Morgan Stanley’s Tesla price target of $400 per share reflects expected value across automotive, mobility services, third-party powertrain sales, energy products, insurance, and network services. Each segment contributes to their bull case as Tesla expands its ecosystem.

Key Drivers of Potential Upside

Morgan Stanley sees Tesla’s service revenue, FSD attach rates, new models like Cybertruck, and further global expansion as the primary drivers of upside potential. Realizing the maximum value across these growth levers could propel Tesla higher.

Tesla Cybertruck Hype Hits Fever Pitch As Preorders Cross 2 Million

Factors That Could Limit Upside

On the downside, Morgan Stanley cautions that competition from mature automakers is rising, Tesla still faces execution risks on new technology, and its valuation remains elevated compared to other auto firms. These factors could limit additional near-term upside from current levels.

AI and Software Offer Big Opportunities

Morgan Stanley sees major upside potential from Tesla’s Dojo AI supercomputer system and software services like FSD and insurance. As recurring high-margin revenue sources, Tesla’s software and AI strengths differentiate them from other automakers.

Morgan Stanley Upgrades Tesla Stock Rating, Sees $500B Potential from Dojo Supercomputer

Federal EV Goals Too Aggressive

The Biden administration aims for 50% EV sales penetration in the US by 2030. But Morgan Stanley thinks meeting that goal is unrealistic given battery supply constraints and charging infrastructure needs. More gradual 25-30% penetration by 2030 seems feasible.

California ICE Phase-Out Also Unlikely

California plans to ban new internal combustion engine vehicle sales by 2035. However, Morgan Stanley again views the timetable as too ambitious. Phasing out ICE sales completely in just 12 years will be very challenging for automakers to comply with.

Trade Protectionism Poses Challenges

Some US politicians have proposed limiting imports of EVs and components from China. But these protectionist policies could backfire by slowing EV adoption and spurring cost inflation. Tesla and other automakers need access to global supply chains.

EV Sales Momentum Slowing?

Despite record EV sales, some dealers indicated demand growth is decelerating in the near-term. Rising interest rates, recession fears, and used vehicle competition may be temporarily weighing on EV purchases with long wait times.

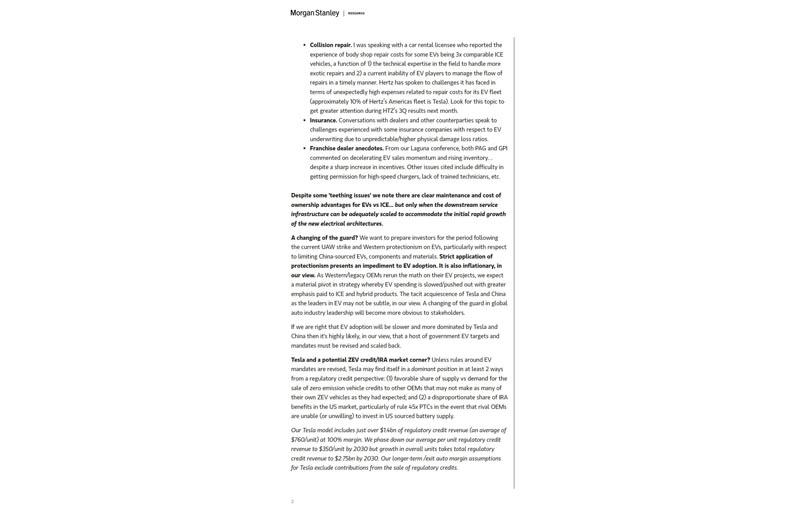

Dominant Position in Regulatory Credits

If other automakers fail to meet their EV sales mandates, Tesla could find itself with an outsized share of regulatory credits to sell to competitors. This would provide a strong recurring revenue stream, especially if compliance challenges persist.

$1.4 Billion in Credit Revenues Modeled

Morgan Stanley’s bull case models over $1.4 billion in annual revenue for Tesla from selling regulatory credits. They assume this declines to $350 per vehicle by 2030 as more automakers eventually meet emission targets. But credits could remain higher if adoption lags.

In summary, Morgan Stanley Adam Jonas believes Tesla retains its leadership position despite broader EV adoption headwinds. While the stock may see near-term volatility around delivery metrics, Tesla’s long-run outlook remains strong. Their innovation and cost advantages position Tesla to dominate the future of sustainable transportation.